Digital Services Tax Resources

IAB Canada members have raised serious concerns about the recent implementation of the Digital Services Tax (DST). We’re actively working with our community to understand and address the challenges it poses. To help you navigate this complex issue, we’ve compiled a list of valuable resources on the DST.

Policy Briefs

- New Updates – IAB Canada Policy Brief: Digital Services Tax – July 2024

- IAB Canada Policy Brief: Digital Service Tax one-pager – February 2024

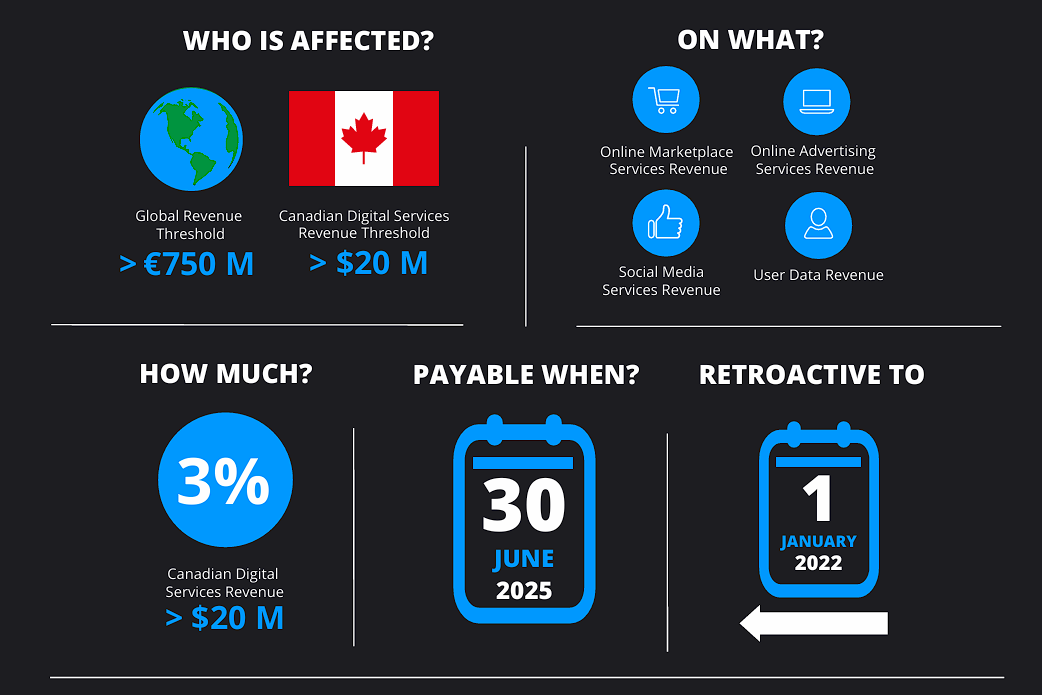

Visualizing the Impact of DST

IAB Canada has created this infographic to shed light on the devastating impact of the DST on our industry.

IAB Canada responds to policymakers

- NEW: DST – Request for Action, February 14, 2025 – IAB Canada sent a letter to Minister Dominic LeBlanc urging the government to repeal the DST, emphasizing its negative effects on businesses and trade relations with the United States. Read the full response letter here.

- DST – Request for Consideration and Action, August 27, 2024 – IAB Canada has sent a letter to the Prime Minister’s office, strongly urging policymakers to reconsider the implementation of the Digital Services Tax (DST). At a minimum we have asked for the retroactive aspect of the DST to be repealed. You can read the full response letter here.

Join the Conversation

Join IAB Canada members for a deep dive into situation with Laura Gheorghiu, L.L.M – Tax Partner at Gowling WLG on September 13th at 11:00am.

Watch the recording here (Member access only) – Webinar Recording: Digital Services Tax (DST) and its Impact on Digital Media – IAB Canada